Post-pandemic market corrections, legislative upheavals and the need for contract manufacturing capacity have caused concern for the biotech industry, but investors may still be pushing for disruptive innovation

Words by Danny Buckland

Biotech investors pulled on the brakes after the rush of booming values during the COVID-19 pandemic, sparking fears of an enduring slump. Although the sector, which saw US stock prices stumble at the end of last year, has not lost its need for speed, its pace has slowed as it navigates some tricky turns.

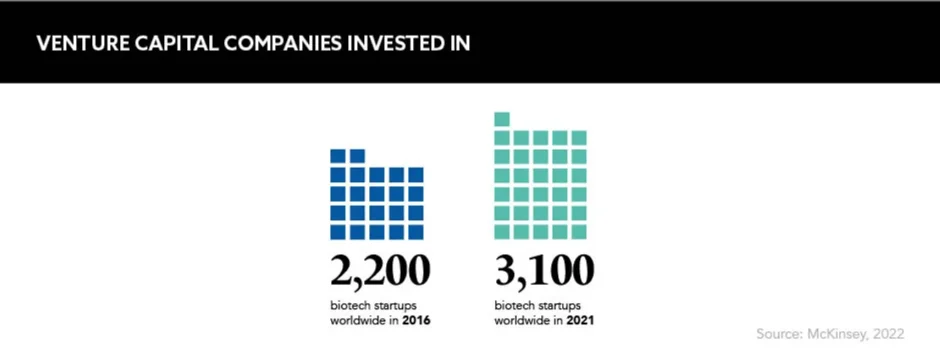

The global management consulting firm McKinsey, which cautioned companies to consider alternative financing and partnership models during the downturn, still believes there is momentum for biotech innovation and growth.

Biotech faces uncertainty from a review of the EU’s pharmaceutical legislation by the European Commission. Due to publish a report in December 2022, proposals for regulatory changes will dictate reimbursement, market exclusivity and IP frameworks for the next generation. Investors, itching to play a part in the innovative revolution that has seen disruptive platforms usher in transformative therapies and cures for previously untreatable conditions, are watching with interest.

The fundamentals for growth in biotech remain strong and grow stronger

Seasoned biotech investor Dani Bach, a partner at +ND Capital, whose career spans venture capital investing and life sciences academic research, was not surprised by the downturn. “The situation in the public markets over the COVID-19 years 2020 and 2021 was untenable, artificially boosted and did not correlate with the real economy, so obviously the bubble had to deflate,” he says.

Strong fundamentals

The pandemic’s well-documented delays, scarcity of goods and scramble to secure manufacturing slots was subsequently compounded by the war in Ukraine, with its inflationary by-product of skyrocketing energy costs causing further angst for the biotech sector.

But the slump appears temporary, according to Bach, who is on the board of several successful biotech companies. “The fundamentals for growth in biotech remain strong and grow stronger: ageing population, prevalence of chronic conditions, increasing demand of best-class healthcare in both developed and developing countries. And, in the midst of all that, pharma’s best solution for its chronic crisis in R&D productivity remains external research, which fuels the biotech industry and the finance of innovation,” he observes.

“All those are here to stay. But, of course, the classical challenges remain, [such as] who is going to pay for all this, and how, as GDP percentage devoted to healthcare keeps increasing? The answers will be important drivers shaping the innovation of tomorrow,” Bach continues.

Claire Skentelbery, Director General, EuropaBio – Europe’s largest biotechnology industry association representing over 2,600 biotech companies – believes it was the deflating global market, rather than sector-specific conditions, that took a toll on investor confidence. “Large companies have an increasing need to get novel treatments into the pipeline, so we are still seeing strong early-stage and startup funding and there is increased activity from private investors, as well as increased money from the European Investment Bank and European Innovation Council,” she says.

Big appetite for disruption

There’s no denying that recent vaccine technology and breakthroughs brought significant attention to biotech, and there’s much opportunity to capitalise on this, as well as the funding that continues to come from public sources.

“There’s a lot more awareness of the potentially high returns from disruptive technologies,” explains Skentelbery. “So, I think the investment glitch was in one specific area of company development rather than a general malaise across the whole sector. There is a really big appetite for the next big disruptive technology,” she says.

Opportunities from new platforms, cell and gene therapies, precision medicine and the increasing role of AI and machine learning in drug development are clear attractions, but the need for contract manufacturing capacity, as well as looming legislative changes, are all challenges.

There is a really big appetite for the next big disruptive technology

“There are tests ahead, but there’s always a drive towards investment in next generation biotechnology, particularly for healthcare, and the challenge is never the science: it is the legislative framework through which that science has to travel,” adds Skentelbery. “We need to be able to make investment attractive for the next generation of technologies for healthcare by enabling companies to unlock investment and ensuring those medicines actually reach patients and make a difference. The science is 5% of the journey – 95% is pushing it through our own constructs.”

Responding to unmet needs

Indeed, these legislative obstructions could hinder progress, and Bach warns that fundamental changes need to take place. “There are areas of unmet medical need for which the market and the regulation does not support the finance of innovation such as antibiotic resistance,” says Bach. “Changes in regulation and payment schemes need to be put in place to unlock this situation in the same way we did in the past with orphan diseases.”

The potential for biotechs to deliver innovative products to the bedsides of patients is substantial and it’s clear that the sector is responding positively to the changing investment landscape to ensure these don’t fall by the wayside.

“We are not in the business of the next best-in-class or fast followers. We are excited by disruptive technologies that allow you to treat conditions that were previously untreatable or to save massive amounts of time and money to payers and patients alike. Very often these are innovations at the convergence between life sciences, engineering and data sciences,” Bach comments. “We are also exploring new business models in prevention, tackling ageing and all its related conditions at once, for example. We are always building on top of world-class science; we don’t take compromises there.”

Skentelbery refers to biotechnology as a frontier technology and it’s clear that no matter what challenges come its way, the industry will indeed push the boundaries of technological capabilities and adoption and speed towards the finish line of providing patients with innovative, life-changing and lifesaving solutions.