In this edition of ‘Pharma in…’, we travel to Spain, where the pharmaceutical sector is thriving as a hub for clinical trials, exports and digital innovation. Yet, timely access to medicines and value-based reforms will shape its next phase

Words by Isabel O’Brien

Late afternoon in Madrid, the winter sun hangs low over the Gran Vía, and the cafes are still full. In Spain, health is woven into daily life – from the farmacia on every corner to a public system that quietly delivers some of Europe’s longest life expectancies. This is the backdrop to Spain’s rise as one of the region’s most dynamic pharmaceutical markets: a place where global players run trials, local companies export billions in medicines and policymakers try to sustain universal care while ushering in the next generation of therapies.

Pharma has become a core industrial pillar. The sector is among Spain’s most productive, exporting over €17bn annually and employing more than 63,500 people in 2024 – making it “one of the largest European clusters in terms of employment”, says Fran Pajuelo, Medical Director, Novo Nordisk Spain.

A leader in clinical research

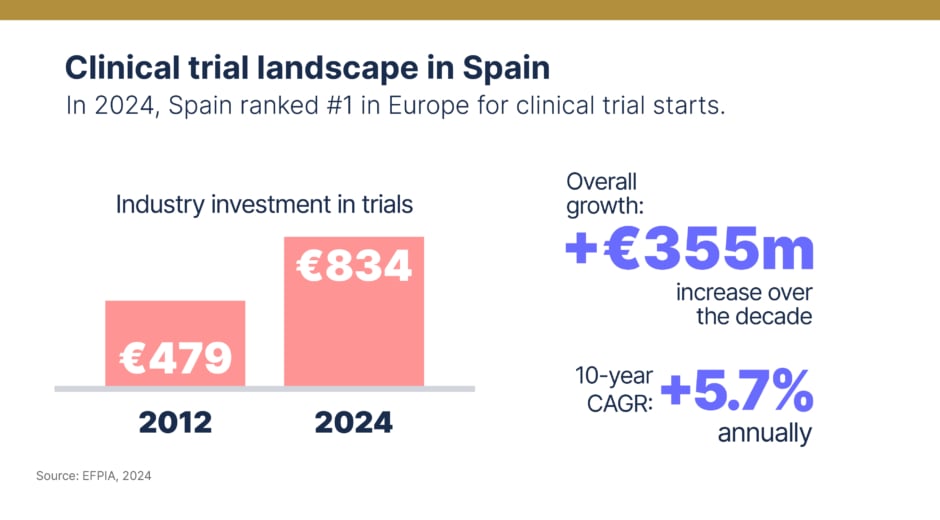

Spain’s ascent is most visible in clinical research, where regulatory efficiency and a dense network of experienced centres have translated ambition into scale. “Spain is the leading country in Europe for authorisation of clinical trials, with around 930 studies approved in 2024, and also leads the coordination of international trials,” Pajuelo notes. EFPIA data shows investment climbing at 5.7% annually over the past decade, reaching €834m in 2022 compared with €479m in 2012. Efficient regulation, collaborative sponsor networks and hubs like Barcelona’s Prime Site – where activity has risen steadily since 2018 – have all been pivotal. In 2024, Spain ranked number one in Europe for trial starts, particularly attractive for multinational oncology and rare disease programmes.

Regulation and the push for stability

The Agencia Española de Medicamentos y Productos Sanitarios (AEMPS) oversees the full lifecycle of medicinal products, from trial authorisations to pharmacovigilance. But approval is only step one: pricing, reimbursement and real-world uptake hinge on Spain’s tax-funded National Health System and its decentralised governance. Pajuelo stresses the need for “equitable access to innovative medicines in Spain”, suggesting cracks in the current model.

Upcoming Medicines Law reforms aim to address those cracks. The proposal would replace the current reference price system – which groups similar medicines and caps reimbursement, often slowing access – with a more flexible price-range model that lets patients choose medicines and pay any difference above the reimbursed level. For Pajuelo, this moment matters: “We have before us a unique opportunity in these regulatory developments to transform the health system and prepare it for the coming years.”

Access, pricing and the cost-value tension

Despite recent improvements – according to the latest data 71% of EMA-approved medicines are now reimbursed, the highest in years – patients still face long waits and uneven access after national approval. Spain’s cost-containment tools, from strict pricing mechanisms to tight budget controls, can slow reimbursement and exacerbate regional disparities. “Addressing these delays is essential for ensuring timely access to breakthrough therapies,” says Elena Alvarez-Baron, Global Medical Director, Angelini Pharma, especially for conditions with high unmet needs. Calls are growing for more value-based approaches: outcomes-based contracts, dynamic reassessments and broader use of real-world evidence.

Decentralisation: local nuance, national inequality

Spain’s decentralised health system defines its pharma landscape. The upsides, Pajuelo says, include “faster decision-making, greater flexibility, user orientation and more efficient management of resources”. It allows companies to co-design pilots with autonomous communities, adapt to local needs and create region-specific value propositions.

But the same system fuels fragmentation. While regional tailoring can spur innovation, “decentralisation poses significant challenges for new therapies”, Alvarez-Baron warns, citing variability in access, formulary decisions and funding. “These inequalities persist, resulting in better or worse outcomes depending on where patients receive care.” For pharma, success increasingly requires sophisticated regional market access strategies that go far beyond a national launch.

Digital health, AI and data

Digital health showcases both the promise and the friction of decentralisation. “Spain has made notable progress in digital health,” Alvarez-Baron says, pointing to widespread electronic prescriptions and medical records. Dealroom data shows the start-up ecosystem is booming too: more than 2,100 digital health companies had attracted nearly €114m across 61 deals by 2024.

But integration remains uneven. Fragmented approaches limit data sharing across regions and “poses challenges for compliance with the upcoming European Health Data Space (EHDS) Regulation”, adds Alvarez-Baron. The EHDS is set to be a European-wide health data highway of sorts, which will connect healthcare systems, researchers and policymakers while keeping patients’ data private and secure.

Meanwhile, pharma companies in Spain are exploring artificial intelligence, like many others, with Novartis piloting a project designed to prepare healthcare workers for the next wave of AI technologies. As Pajuelo explains: “At Novo Nordisk we have developed Buenos días, IAs (‘Good Morning, AIs’), to help medical experts deepen their knowledge of AI and learn how innovative tools can improve patient care.”

What it will take to unlock Spain’s full potential

For many leaders, Spain’s next phase of its life sciences journey will depend as much on culture as on regulation. “We would speak of a change that promotes the culture of data-based management, the integration of AI and, above all, the encouragement of a proactive mindset for change,” says Pajuelo. That means broader use of real-world data, more informative outcome measures and a willingness to rethink entrenched processes. Alvarez-Baron is even more direct: “The most impactful change would be a shift within public institutions from a cost-containment mindset to a value-based approach.”

For a country ranked eighth worldwide and fourth in Europe for pharma sales – and number one in Europe for clinical trial starts – the question is no longer whether Spain matters. It does. The real test is whether Spain can align its industrial strength, research leadership and digital momentum with faster, fairer access to new therapies, so patients in every region can feel the full benefit of its life sciences renaissance.