As pharma raced to meet climate targets in 2024 to 2025, the industry is beginning to prove that scaling life-saving medicines no longer has to mean scaling emissions

Words by Dr Meetal Jotangia

For decades, the pharmaceutical industry has operated with a primary prerequisite in mind: to scale production and reach more patients, environmental impact must inevitably rise. Today, the sector is turning this dogma on its head, moving ever closer to the “great decoupling” benchmark. This shift highlights that life-saving medicine no longer requires a trade-off with the wellbeing of the planet.

Where cuts are working

On many fronts, pharma is beginning to decouple growth from carbon by embedding sustainability across the product lifecycle. A primary driver is green R&D, the practice of designing medicines with a reduced environmental cost before they leave the lab. By selecting solvents with lower lifecycle impacts and streamlining chemical synthesis, firms are ensuring intrinsic sustainability that reduces CO2 regardless of sales volumes.

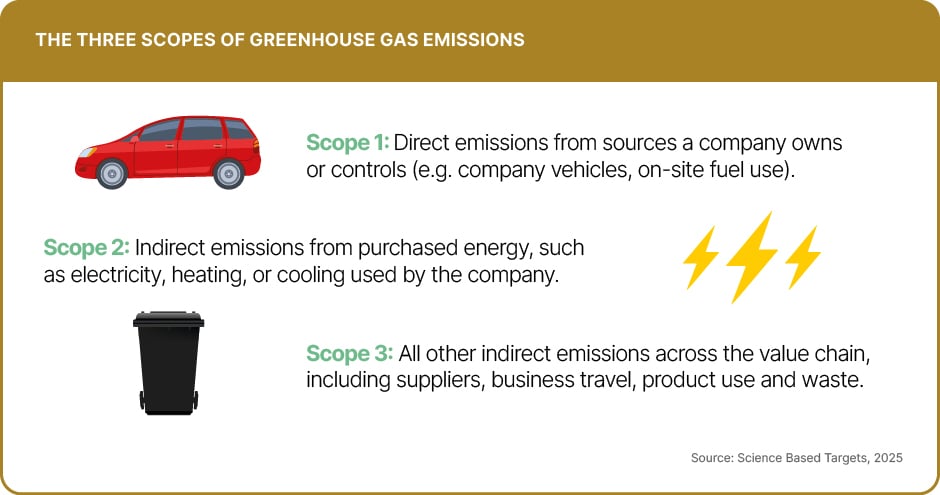

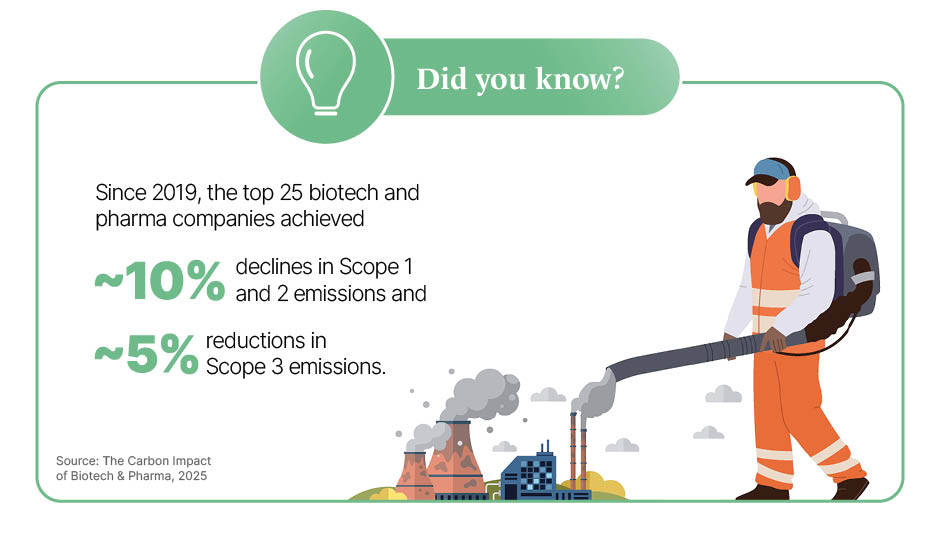

These R&D advances have translated into visible victories in recent years, particularly across Scope 1 (direct operations) and Scope 2 (purchased energy), supported by radical engineering shifts. AstraZeneca stands out as a benchmark, having reduced Scope 1 and 2 emissions by 77% since 2015, as of 2024. Its strategy centres on hard-to-tackle areas of production, including replacing natural gas with biomethane for high-heat manufacturing and transitioning its global sales fleet to electric vehicles.

Simultaneously, companies such as Novartis and GSK are addressing Scope 2 emissions by committing to 100% renewable electricity across owned sites. This is through a mix of on-site solar arrays and long-term virtual power purchase agreements that add new green capacity to the global grid.

The hard part

While progress in direct operations is accelerating, the industry’s greatest challenge lies in the value chain (Scope 3), which typically accounts for more than 80% of total pharmaceutical emissions. Manufacturing and raw material procurement – including active pharmaceutical ingredients (APIs) – make up the bulk of this footprint.

This difficulty was highlighted by the rapid scaling of blockbuster GLP-1 medicines by companies such as Novo Nordisk. In 2024, unprecedented patient demand drove a temporary spike in value-chain emissions, revealing that supply-chain infrastructure has, in some cases, yet to catch up with commercial success. To tackle this, strategic interventions are beginning to re-code the DNA of the pharma supply chain, both upstream in manufacturing and downstream in product use.

What’s moving the needle

Upstream, the Sustainable Markets Initiative, a CEO-led coalition of global pharma leaders and health organisations dedicated to decarbonising healthcare, continues to thrive. In 2025, AstraZeneca, GSK, Takeda and other partners, strengthened their commitment to creating enough demand for clean power to make renewable electricity viable for suppliers in China. This agreement is expected to unlock roughly 225 GWh of renewable electricity annually for the manufacture of medicines, potentially avoiding around 250,000 tonnes of CO2 emissions per year – comparable to taking 50,000 cars off the road.

Downstream, companies are driving product innovation in respiratory care to cut use-phase emissions. The year 2025 marked the successful phase 3 clinical completion of next-generation, low-carbon inhalers. For leaders like GSK and AstraZeneca, respiratory devices are a strategic necessity for decarbonisation. For example, traditional inhaler propellants currently account for roughly 49% of GSK’s total carbon footprint. New formulations are projected to slash patient use emissions by over 90%, and with their roll out slated for the start of 2026, the industry is positioned for a massive, structural drop in Scope 3 emissions.

What comes next

Looking ahead, the industry must shift from reducing waste to predicting and preventing it. While green chemistry focuses on cleaner reactions, the next phase lies in technologies such as digital twins – virtual replicas of factories that allow production processes to be tested digitally before being deployed in the real world. Combined with artificial intelligence modelling, these tools would allow R&D teams to simulate entire lifecycles, cutting material waste and energy use by spotting inefficiencies before a single pill is made. Over the next decade, this approach could embed sustainability into the digital blueprint of every medicine.

This transition will be accelerated by the EU Corporate Sustainability Reporting Directive (CSRD), which has transformed sustainability from a voluntary ambition into a mandatory, financial-grade audit requirement. Under the CSRD, companies have a duty to fully adopt automated manufacturing that uses real-time sensors to optimise energy use independently.

The new regulation, alongside the other key markers of progress, signals a fundamental evolution in the industry’s purpose to cut emissions. While drug production has historically been associated with environmental harm, recent progress proves that the pursuit of life-saving therapies no longer necessitates the degradation of the planet’s vital ecosystems.