A deal ends months of wrangling between the UK government and the ABPI, but what will it mean for the industry and the UK’s bid to become a life sciences superpower?

Words by Danny Buckland

It has been hailed a “momentous” deal by healthcare chiefs that will herald an exciting, transformative era for the NHS and the life sciences sector.

The new Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG) deal, announced after fraught and protracted negotiations, brings certainty, but will it appease the critics of its unpopular predecessor VPAS?

New deal, new rules

Described as “tough” by Richard Torbett, CEO, the Association of the British Pharmaceutical Industry (ABPI), the new contract promises much but still exacts significant costs for industry at a time of worrying signals about the UK’s ability to attract life sciences investment.

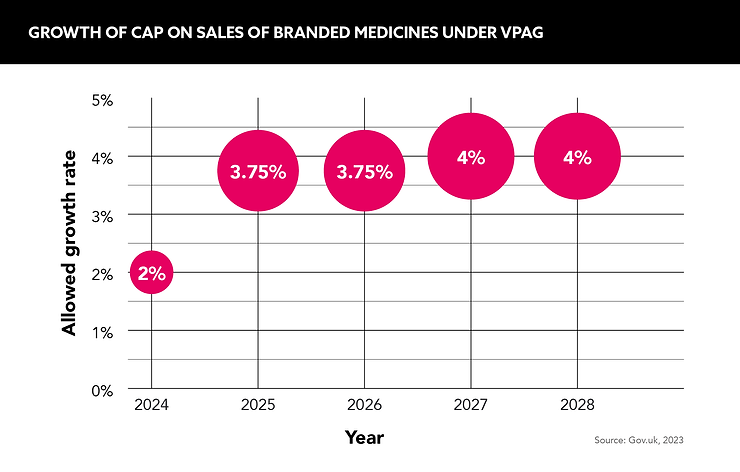

The five-year VPAG, which will come into effect at the start of 2024, doubles the annual cap on sales of branded medicines to the NHS before a levy is charged from 2% to 4% by 2027. An affordability mechanism has also been built in to charge a higher levy on older medicines to support lower rates for newer, innovative medicines.

It is forecast to save the NHS £14bn over its term and, combined with extra investment measures from both government and industry, help advance clinical trials, manufacturing and access to the latest life-saving medicines. But whether it goes far enough to enable the UK to continue to aspire to be a leading global bioscience nation remains to be seen.

Superpower status

In the lead up to the deal, The Society of Chemical Industry warned that the UK is slipping down the life sciences superpower rankings. It urged government to support the effective translation of research into applications and to leverage private sector R&D investment.

The ABPI took a similar view, stating in October 2023 that if current rebate rates remained in place, it would cost the UK economy £50bn by 2058 and jeopardise £1.9bn of R&D investment – investment that many believe to have already fallen.

This includes Dr Angela Kukula, CEO, MedCity, the biotech, medtech and pharma cluster in London, who observes: “The VPAS pricing and access scheme, designed to limit the cost of branded medicines to the NHS, is now discouraging pharmaceutical companies from launching drugs in the UK. This must be addressed to allow the sector to thrive.”

Cause for concern

While VPAG has lowered the rebate rates, industry believes the deal could still be detrimental to the UK’s life sciences reputation.

The British Generic Manufacturers (BGMA) has sounded the alarm which, although its member firms supply four out of five medicines used by the NHS, was excluded from the VPAG negotiations. Mark Samuels, CEO, BGMA, believes elements of the new deal would disadvantage, and discourage, generic manufacturers and lead to more shortages of off-patent medicines as “razor thin” margins are squeezed even tighter.

While he found the increase in the overall growth rate “heartening”, he said the fact that the rate will still be 2% next year will continue to create a risk of drug shortages. “The problem is that it makes some medicines loss-making and once a generic manufacturer makes a loss on a product, it is hard for them to continue supplying it,” he explains.

It makes some medicines loss-making

Tough reimbursement conditions have already started to deter global generics and pharma companies from even investing in the UK. “They’ve put over £4bn of investment in European countries in the last few years, and virtually none in the UK,” adds Samuels.

Not all bad news?

It may not be perfect, but the ABPI “supports” the VPAG deal, according to Torbett. In fact, he believes that it will enable “the sector to grow faster than it has under the previous scheme and should increase the UK’s international competitiveness over time”.

Torbett also welcomes Chancellor Jeremy Hunt’s commitment in his Autumn Statement to fund a new £520m R&D tax credit scheme for drug manufacturers, saying: “These steps will help give confidence to companies looking to make larger, long-term investments into the UK.”

In the Autumn Statement, the UK government pointed to a mosaic of measures and incentives – from data to research to manufacturing – as evidence of its commitment to keeping the UK in the life sciences fast lane. However, its own Life Sciences Competitiveness Index shows a marked decline in foreign direct investment in recent years.

Nevertheless, Kukula believes the UK “undoubtedly has the potential to achieve superpower status, given that we have a world-leading science base”.

Will VPAG help the UK achieve this? That is unclear at present and will have to be assessed as part of a range of initiatives that promise a positive future. What is clear, though, is that the new deal will test patience and profit margins, but perhaps only initially.