The Eli Lilly ‘blue tick’ scandal is the latest in a series of challenges facing new Twitter CEO Elon Musk. Should the pharma industry worry about reputational risk or return to the platform?

Words by Isabel O’Brien

On 26 October 2022, and to the dismay of many, including perhaps himself, Elon Musk became the owner of Twitter. Well-publicised sackings and encouragement of resignations followed, with Musk hoping to be left with a streamlined, ambitious workforce who could transform the company’s prospects.

Instead, key talent walked out, service outages loomed and doubts were cast over whether tweets could be effectively moderated with such a reduced staff size. In response, the new CEO introduced the Twitter Blue subscription, which aimed to democratise the platform’s iconic ‘blue tick’. Unfortunately, far from solving his problems, the move landed Musk’s company in hot water with Eli Lilly and several other pharmaceutical companies around the world.

Disaster strikes

“Nearly half of our clients paused their Twitter advertising within a week following the Eli Lilly incident,” says Matthew Snodgrass, Head of Digital and Social Strategy, Syneos Health Communications.

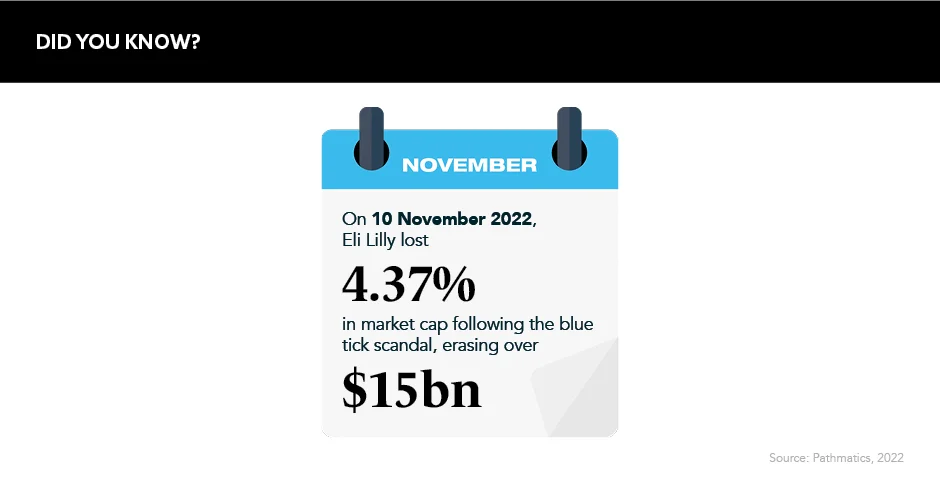

About 15 days after Musk’s takeover, a fake Twitter account pretending to be Indianapolis-based pharmaceutical company tweeted with a paid blue tick: “We are excited to announce insulin is free now.” Not all publicity is good publicity, and Lilly lost 4.37% in market capitalisation that day. The tweet was only live for six hours, but it gained over 10,000 likes and thousands of retweets.

David Ricks, CEO, Eli Lilly, said the situation was not dealt with “quickly enough to our liking” and promptly pulled his company’s advertising spend from the platform. Other organisations followed suit, with boycotters including Novo Nordisk and Sanofi, two of the other major insulin manufacturers in the US. This spelled bad news for Twitter, which gained 90% of its $5bn revenue from advertising in 2021, but worse news for patients and healthcare professionals.

The biggest question mark is the future of Twitter itself

While pharma has never been ranked in the top percentile of tweeters, the platform has become a valuable tool for extracting and disseminating insights in recent years. “Twitter had become quite popular,” confirms Snoddgrass, describing how the platform gradually became “de rigueur” for pharma companies following a frosty reception when it debuted.

The early days

When Twitter launched, the pharma industry was reluctant to sign up to the platform. “Many pharma companies have been late adopters of social media, compared to other industries,” says Jessica Bodoutchian, Global Digital Manager, DFE Pharma. The site was viewed as having regulatory grey areas and unclear policies, she says, but mostly “fear of backlash or controversies” slowed down adoption.

Still, a shift began to take place around 2009 – the same year Twitter won the ‘Breakout of the Year’ Webby Award – when companies such as AstraZeneca, Novartis and Boehringer Ingelheim set up accounts and began sending daily updates. But, for a long time, posts were restricted to investor-related news.

Nearly half of our clients paused their Twitter advertising within a week following the Eli Lilly incident

The void of wider marketing content was largely linked to Twitter’s then 140-character limit. Selected to mimic the length of an old-fashioned SMS, the brevity of posts posed compliance issues for drugmakers. “This was a real concern for pharma, who was used to having to share long, fair balance text in their marketing,” reveals Snodgrass. For many companies, the potential impact did not justify the legal risk.

In addition, patients and doctors took a while to build networks on Twitter, but this changed when those involved in patient groups, medical societies and congresses joined to share information with their relevant communities. As a result, “pharma companies have embraced Twitter as a useful tool to reach patients, but especially healthcare practitioners”, observes Bodoutchian. She highlights research by Pathmatics, which states that pharma dedicated around 3% of its budgets to Twitter advertising in 2021.

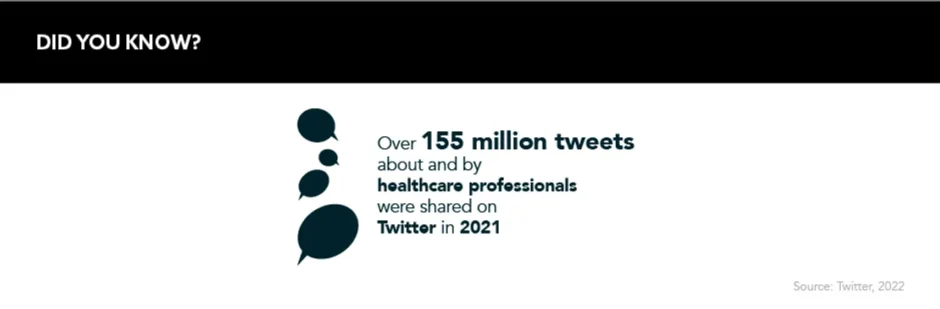

This is not a huge investment in comparison to other platforms like Facebook, which, according to Bodoutchian, took 40% of total budget spend, but it shows the industry was willing to leave its comfort zone to connect with HCPs and patients. “The fact that so many of a pharma company’s stakeholders have a presence on Twitter should make it a very popular channel for them,” confirms Snodgrass. Research by Twitter has revealed that over 155 million tweets about and by HCPs were shared on the site in 2021.

Is Twitter valuable?

Despite the opportunities offered by Twittersphere, the recent scandal has left the industry’s future on the platform hanging in the balance. How could this negatively impact the companies withdrawing?

Twitter doesn’t appear to be a key platform for pharma marketers in terms of expenditure, but it does have unique qualities that help them to target key stakeholders. “Whether it’s medical journalists, investors, advocacy, HCPs, potential employees, patients or caregivers, Twitter affords pharma the opportunity to distribute an unfiltered message in an easily digestible format that has the feel of the old news ticker,” says Snodgrass.

The platform is particularly beneficial for sharing real-time insights from congress, for example, enabling study findings to reach a wider audience of HCPs and potentially leading to increased awareness of new therapies and peer-to-peer recommendations. Live and open discussion forums are well documented to be key in influencing prescribing habits. Indeed, Snodgrass believes Twitter’s speed-to-market is a key part of its usefulness for the industry.

Twitter is also a fantastic social listening tool

Another perk specific to the US is Twitter’s ability to help marketers execute direct-to-consumer drug campaigns. The social tool enables marketers to target stakeholders who “might be harder to target on other platforms, thanks to its granular segmentation based on keywords, accounts and interests in a cost-effective way”, says Bodoutchian.

The platform, in the same way as other social media sites, is especially attractive for marketers looking for an alternative to expensive and ill-targeted television adverts, which Forbes notes as costing between 1.7m (USD) and 2.2m (USD) for a 30-second spot in 2022.

“Twitter is also a fantastic social listening tool that allows pharma companies to understand the concerns of patients, medical associations and patient associations,” Bodoutchian adds. Patients gather on the platform to discuss the benefits and downfalls of drugs and even to report adverse events, all of which can lead to valuable insights that can help marketers and other teams to shape their future strategies.

While Bodoutchian admits “many brands are probably still using Twitter as a monitoring and listening platform to make sure they stay up to date and don’t miss out on the conversations”, as there’s potential for active engagement with these communities, which can enable pharma to extract more specific insights to guide their activities. Laying low for too long could lead this process to be negatively affected.

There would clearly be losses to be shouldered if the pharma industry cut ties with Twitter completely, particularly as HCPs and patients remain just as active on the site. Marketers may not consider Twitter to be the most valuable social media tool on the market, but it could be unwise to close the door completely.

Restoring the faith

That said, in the first week of 2023, over two months after the Eli Lilly Twitter scandal hit the headlines, many of the top pharma companies were still withholding marketing spend or posts to corporate accounts on the platform. Stakeholders may be unfazed by the chaos and disruption, but scepticism regarding its future continues in pharma circles.

“We are advising a ‘wait and see’ approach,” says Snodgrass. “At its core, Twitter is still functioning as it always did, which is why we’re sticking with it. When that changes – or if or when Elon Musk continues to degrade the corporate mission of the platform – that will certainly give us pause, which would be a shame.”

It is difficult to ascertain whether the damage caused by Musk’s premiership will be permanent or reversible in nature, but Bodoutchian highlights that social platforms have suffered and survived before. “Other platforms like Facebook have survived similar advertising boycotts in the past, taking hard blows but without putting their survival in risk,” she explains. “I believe the biggest question mark is the future of Twitter itself.” The forecast for Twitter is far from clear skies, but all hope is not lost due to Musk’s attempts to transform its trajectory.

The Twitter Blue subscription has been relaunched, with the blue tick now selling at a higher cost with increased verification procedures and more perks for buyers. With the memory of losing 4m USD per day looming large, this subscription could well become a revenue source that the platform so desperately needs. So far, there has not been a surge in fake account occurrences.

Musk has also promised to relinquish control of the social media site after a poll he ran indicated that 57.5% of users believed he should step down as CEO. Musk says he will once he can find someone “foolish enough to take the job”. If such a person exists, they will have their work cut out to revive the credibility of Twitter, but it is not beyond the realms of possibility.

Twitter’s fate may not be sealed, but pharma companies will likely keep riding out the storm from the sidelines. This includes redirecting their ad spends to rival sites. “We’ve seen some ad dollars evenly redistributed to other social and digital marketing platforms,” says Snodgrass, pinpointing LinkedIn, Facebook, Instagram, TikTok and paid search as the lucky recipients.

Twitter’s loss could be its competitors’ gain. But, on balance, the pharma industry should think twice before leaving behind a valuable audience of stakeholders out of fear of scandal and corporate defamation.